Here’s a recent stat that might surprise you. Gallup research found that engaged employees require a substantial 31% pay increase to consider taking a job with a different organization. Meanwhile, not engaged or actively disengaged employees would do the same move for only a 22% increase.

This near double digit percentage disparity underscores the vital role of employee engagement in today’s workforce. It showcases that companies that decidedly invest in their employees are less likely to lose them to turnover – and pay the price of that turnover.

With that in mind, employers and businesses have found effective ways to fight this trend and increase engagement, such as working with a Professional Employer Organization, better known as a PEO.

At their core, PEOs are firms that partner with businesses to provide comprehensive human resource services. The partnership allows companies – especially small to medium-sized ones – to outsource crucial HR functions such as employee benefits, payroll administration, regulatory compliance, and workers’ compensation. By doing so, these companies can focus more on core business operations while ensuring HR needs are expertly managed.

State of the Union: Key Challenges for PEOs

The economic landscape of 2024 is marked by uncertainty and a scarcity of top talent. These challenges, which were outlined by the iSolved report at NAPEO 2023, are generating significant concern and sleepless nights among HR professionals.

These challenges will have significant implications for PEOs and their clients. The dual pressure of economic instability and talent shortages means that PEOs will need to strike a delicate balance. They must provide cost-effective HR solutions while also offering attractive benefits packages that can lure and retain top-tier talent.

A recurring theme of the NAPEO conference was the vital importance of enhancing financial wellness and employee benefits. And according to Gallup Insights, the following points are the biggest challenges for HR professionals right now.

- Quiet Quitting: The phenomenon where employees are physically present but lack engagement or enthusiasm for their work.

- Employee Stress: High stress due to low resources is leading to burnout and reduced productivity.

- Active Job Seeking: Nearly half of the workforce is actively looking for new jobs, which indicates widespread dissatisfaction with current employment.

- Employee Engagement Matters: The study finds that now, more than ever, employee engagement is a key driver of retention and productivity.

The Continued Rising Importance of Financial Wellness and Benefits for Employees

To combat these trends and provide a better overall place of employment, intelligent employers are going back to the basics. People work jobs to make money. But what does the concept of money actually mean these days?

First, let’s move beyond dollar signs, and take a look at the concept of financial wellness as a whole. The reality is that financial wellness is a cornerstone of employee retention. But is your company hitting the mark? Is it providing its employees with what they need beyond a paycheck?

By working with PEOs, companies can craft a holistic financial wellness approach that takes into account the broader implications and the strategic importance of overcoming these hurdles.

What Are the Benefits of Meeting PEO Challenges?

By effectively meeting these challenges, companies can not only enhance their operational efficiency but also significantly boost their attractiveness as employers. For instance, a study found that 57% of U.S. employees cite finances as their top cause of stress. Addressing financial wellness can therefore play a pivotal role in alleviating this stress – leading to more engaged and productive employees.

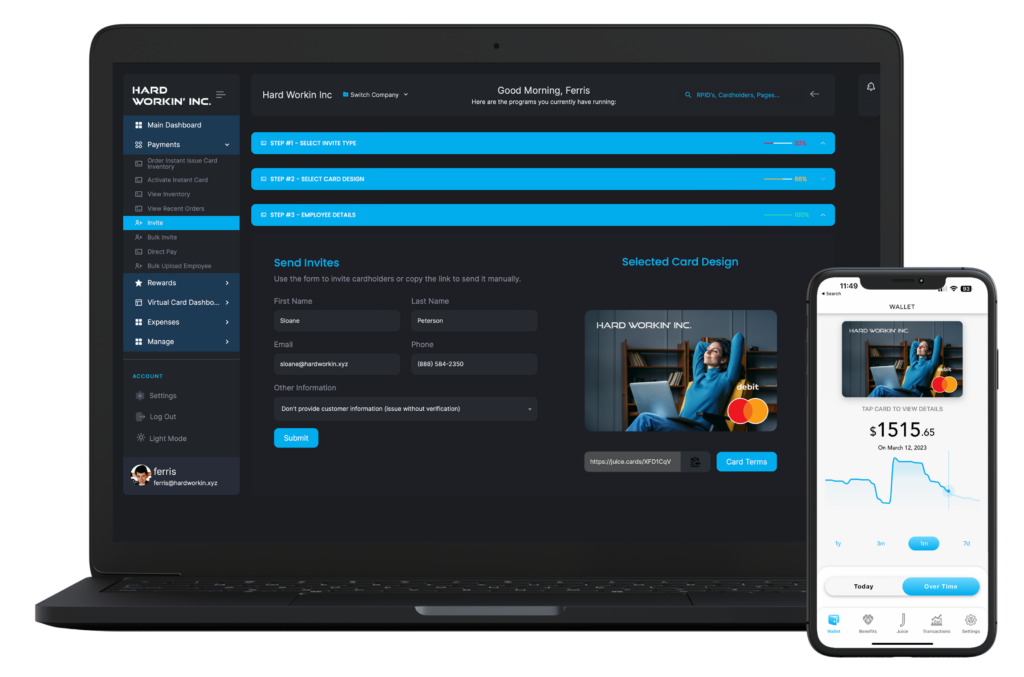

And Juice’s single, intelligently linked systems offer an elegant solution to these complex problems. By integrating seamless FinTech tools into the PEO framework, Juice helps to create a work environment that better supports financial wellness and fuels better engagement and retention. This approach is not just about managing financial transactions but about fostering a culture of wellness and support.

How Juice Financial Solves These Problems for Employers and PEOs

Juice Financial offers innovative FinTech solutions, notably in the forms of paycards and Earned Wage Advance (EWA) services – not to mention our custom integrations and solutions. These tools offer a new level of convenience and control to employees directly addressing their financial stress and needs.

The benefits of these offerings are particularly compelling during times of economic uncertainty. These tools empower employees with immediate access to their earned wages, providing an element of financial flexibility and wellness. And as Gartner research points out, employees who feel more positive about their work environment are more productive at their jobs.

Enhancing Talent Attraction and Retention

Moreover, these financial tools are not merely perks, but they’re essential in constructing a holistic employee experience. That’s something that couldn’t be more valuable in today’s competitive job market. The right kind of benefits can significantly differentiate a company, making it more attractive to current and potential employees.

Implementation of these tools also signals to employees that their employer cares about their financial health and well-being. In turn, this can lead to higher levels of engagement and loyalty. It’s not a revolutionary thought, but it bears repeating: People want to work for employers that respect them.

Expense and Reward Solutions

Of course, a PEO’s relationship with clients often goes beyond payroll, which is why having a range of modern solutions at your fingertips is imperative. Solutions for Expenses and Rewards are two additional offerings you can bring to your clients, adding additional value in those relationships.

For Expenses, imagine offering your clients a solution where they can issue instant, virtual-first expense accounts – and even lock those accounts so they can only be spent at certain types of merchants! If it’s a travel expense card, this might entail locking it down to air travel, hotels, rental cars, taxis, and restaurants. If it’s a gas expense card, only gas stations. All of this – and more – is possible with Juice. Your clients can issue custom-branded (that’s right – their company logo on the front of the card) expense cards with enormous controls. Bottom line: better expense programs with less expense fraud!

For Rewards, Juice offers a holistic solution for issuing digital accounts for stipends, reimbursements, and more. Does a client want to offer a cell phone reimbursement or gym membership stipend? Juice makes it easier than ever. And just like our Expense program, you can lock down cards so they’re only spent as intended.

Financial Solutions Today Improve Business Tomorrow

The decisions companies make regarding financial solutions have far-reaching implications. Immediate needs must be addressed, yes, but best practices mean strategically positioning for the future. Smart financial choices made today can significantly improve business resilience and competitiveness tomorrow.

Combining the use of proven PEOs and innovative FinTech solutions, like those offered by Juice, can be a gamechanger for businesses. The solutions offer more than a simple immediate relief or convenience. Instead, it’s a way to lead proudly into the future, suggesting a holistic understanding of the evolving economic environment.

Why Juice Financial is Best Suited to Deliver These Solutions

With over 30 million customers served and billions in payments processed, the Juice track record speaks for itself. We view ourselves as a partner committed to enhancing the experiences of both your team and clients, helping you offer a better overall PEO product.

It’s not just about transactions. We’re about relationships, growth, and mutual success. Our technology is our promise, and our team is our delivery – always ready, always innovative, and always committed to propelling our PEO partners and your clients to new heights.

Want to learn more about the Juice way? Contact us today!