The traditional paycheck is a relic of the past. These days, employees not only prioritize flexibility in hours and schedules, but they desire control over how and when they’re paid.

Further, a large portion of the workforce doesn’t have access to a traditional bank account. For those employees, receiving a traditional paycheck means the headache of paying check cashing fees in order to access money they already worked for. Plus, employers have to pay administrative fees to distribute paychecks. The system makes no sense – a no-win situation that takes advantage of both employees and employers.

Juice, as the industry’s leading FinTech provider, recognizes this challenge. While serving over 15,000 clients with over 30 million accounts on our platform, we’ve seen what is valued by both employees and employers.

Here, we break down the Juice pay card solutions, explain exactly what is a pay card along with the challenges of traditional payroll methods, and offer real-world examples of pay cards’ positive impact.

So Exactly What Is a Pay Card?

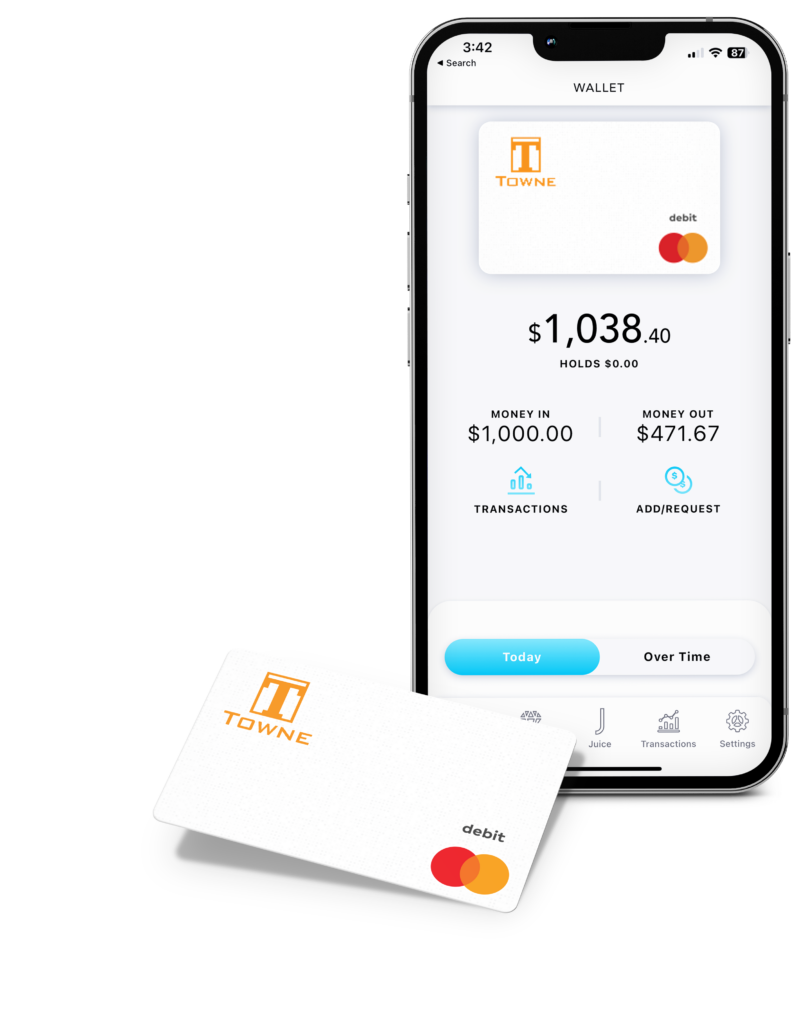

First, let’s define exactly what is a pay card. Simply put, rather than issuing payroll via paycheck or direct deposit into a bank account, the payment is issued directly into a digital account connected to a physical debit card, both issued by Juice. This offers distinct benefits to both the employer and employees.

The Challenges with Traditional Payroll Methods

But why are pay cards needed when other forms of payroll exist?

For starters, The Federal Reserve shows that about 17% of households earning under $25,000 annually are either unbanked or underbanked. Pay cards offer employers an effective and convenient way to pay them that doesn’t require traditional bank accounts.

But beyond that, traditional payroll methods – notably paper checks – come with their own set of obstacles. For these underbanked employees, this is as annoying as it is costly. Cashing a paycheck often incurs fees – ranging between 1 and 12% of a check’s total value. That’s a significant financial burden for a considerable portion of the workforce!

Moreover, 60% of Americans live paycheck to paycheck. For them, traditional payroll programs and pay cycles pose hurdles. Certain pay cards, like those from Juice, offer the ability to receive pay right after a shift ends.

The bottom line is that a growing part of the workforce simply demands flexibility in how they get paid. A recent survey of over 500 nursing professionals showed that they value flexibility more than ever. This is indicative of a larger trend, and one that employers must recognize – both for the sake of your employees and to stay ahead of competition.

“If you are not adapting and developing new ways to attract candidates — flexible schedules, same or next day pay options, etc. — you will continue to fall behind and recruitment and retention will continue to be a challenge.”

– Kendra Nicastro, director of business development for healthcare recruitment firm LeaderStat via McKnight’s Long-Term Care News

Pay Cards Offer an Innovative Payroll Solution for Employees and Employers

Juice pay cards bring tangible benefits to both employees and employers. For employees, they provide a modern way to access wages without the burden of check cashing fees.

Employers, on the other hand, see massive improvements in reducing administrative work and costs associated with paper check processing, and an increase in employee satisfaction and retention. You can even customize every part of your Juice card experience – from the physical cards to what employees see in the app to the physical carrier cards arrive in – building your brand and earning even more trust with employees.

The research backs up the effectiveness of pay cards, too. 84% of employers find that offering financial wellness tools like pay cards significantly increases employee retention. Employees take greater control over their finances, and employers offer a show of faith and commitment to the overall well-being of an employee’s work and life.

Real-World Success: How Juice Pay Cards Transformed Towne Nursing

All of this sounds nice in theory, but what does the real-world impact of a Juice Pay Card program look like?

Towne Nursing, a northeast-based healthcare agency, was facing employee demand to stop offering paper checks. Juice helped them implement a custom pay card program to transform their business in a highly competitive market. The agency switched off of a paper check approach and implemented a same-day pay program with reloadable debit cards.

Suddenly, employees had quicker access and more flexible access to pay, and for underbanked employees, it eliminated check on cashing fees. Further, the change eliminated the need for employees to find a way into the office to collect their checks.

The result was not only a more satisfied workforce, but a significant reduction in administrative work and costs:

-

- Eliminating physical checks saved over 80 hours per month in administrative work.

-

- Employees collectively saved over $277,000 in check cashing fees.

-

- The immediacy and accessibility of funds led to significantly increased employee satisfaction.

The takeaway is that pay cards might seem like a small change, but for both employee happiness and employer’s operational efficiency, they can be transformative.

Couldn’t your organization benefit from spending less on paper checks and administrative work, all the while better delighting your workforce? The Juice solution promises to do this at no cost to your business. What other solutions can say that?

What is a Pay Card: How Juice Pay Cards Power the Future

After processing over $20+ Billion in client transactions, we’ve learned a thing or two about moving money.

With more than 15,000 clients on our platform and more than a though sane instantly deployable use cases, leveraging more than 100 banking solutions, Juice is the fastest and easiest way to integrate financial solutions into your business.

$

0

M+

Accounts On Our Platform

$

0

B+

Gross Volume Processed

0

+

Digital Banking Solutions

0

+

Clients On Our Platform

0

+

Years In Business

$

0

M+

Invested In Our Technologies

Now, you should have a better understanding of, “What is a pay card?” And here’s why it matters: a shift to Juice pay cards is a significant way to address the financial needs of today’s workforce. They address immediate needs of getting paid efficiently and conveniently.

Juice understands the true power, because we’ve seen it happen over and over again. Over the years, we’ve processed over $20 billion in client transactions across 15,000 clients. Our innovative technology stands alone, bringing modern FinTech solutions to problems from employee pay to expenses, rewards, and hundreds of custom solutions.

The best part is that unlike most companies, Juice can get your company up and running in days, not weeks or months. Thousands of companies have relied on Juice’s Quick Start program to get pay cards issued to their employees quickly. Since our program is unique in that it’s digital-first, your employees can get started immediately by adding their card to their mobile wallet before their card arrives in the mail.

Get started Juicing up your business today!