Embedded finance is disrupting the financial transaction landscape. In fact, some analysts forecast the embedded finance market could reach $622.9 billion by 2032.

And for certain industries, such as insurance, the impact is being felt even more. According to a report by InsTech London, it’s predicted that the embedded insurance market – an extension of the embedded finance ecosystem – could grow to $722 billion globally in Gross Written Premiums by 2030. That’s 600% more than the size that is today.

What’s fueling this growth is efficiency and the ability to move through customer claims much, much faster. Insurers who incorporate financial services directly into offerings can bypass traditional, cumbersome payment methods to deliver a more seamless and efficient customer experience. In practice, that means the innovative tech integrates with existing insurance systems to offer instant disbursements through digital accounts and debit cards. This not only streamlines operations, but also meets the evolving expectations of policyholders.

In other words, no more waiting around for that insurance check to arrive in the mail because the process has been made easier from start to finish for all parties involved.

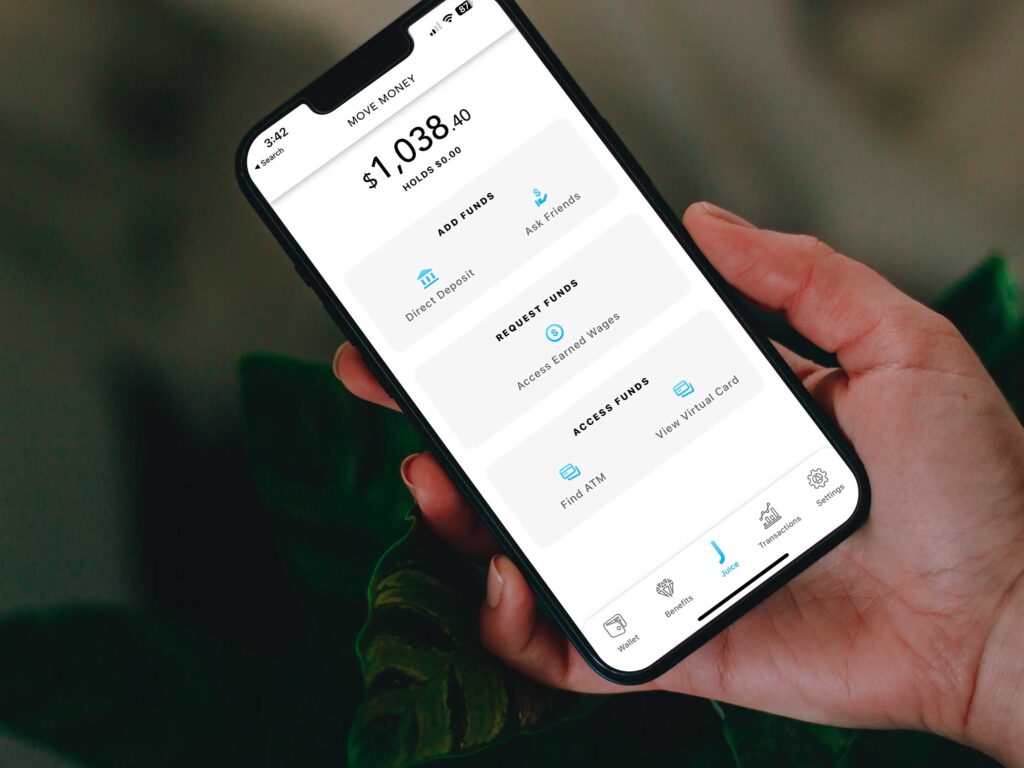

At Juice, we’re disrupting this space by offering a product that integrates with your system and provides instant disbursements by issuing a digital-first account to beneficiaries. Let’s break it all down further.

The Challenges of Traditional Insurance Disbursements

Conventional methods of insurance disbursements come with a host of challenges that can hinder efficiency and customer satisfaction. The reliance on paper checks, for example, can lead to significant administrative overhead, delayed payments, and an increased margin for error.

- Claims Inefficiency: Waiting 15-20 days for a claim payout is an all-too-common frustration for policyholders, leading to dissatisfaction and potential loss of business.

- Admin Costs: The cost of processing a single paper check can be $10 or more. Across hundreds of thousands or millions of claims, that’s a significant cost driver for insurance companies.

- Data Inaccuracy: Paper checks carry the inherent risk of data inaccuracy due to manual processing, which can lead to payment errors and contribute to further delays and administrative burdens in insurance disbursements.

- Customer Experience: Slow, paper-based claim processes can affect an insurer’s reputation and diminish policyholder loyalty.

These challenges underscore the need for a more efficient, secure, and customer-friendly approach to disbursements – a need that embedded finance is uniquely positioned to fill.

Impact of Inefficiencies on the Insurance Sector

But how do these challenges actually impact firms in the insurance industry? Unfortunately, there’s quite the ripple effect and the result can be far-reaching financial and operational consequences.

For instance, the repercussions of relying on outdated disbursement methods like paper checks and manual processing are extensive, affecting both the financial health and operational dynamics of firms. A report by PYMNTS underscores this point, revealing that 62% of businesses, including those in insurance, still use checks to pay for goods and services. That reliance translates into a considerable amount of resources focused on administrative tasks. The cost goes beyond monetary, too – it’s a reduction of efficiency and innovation.

Further, reputations matter – you only get one of them. According to Deloitte Insights, 44% of US consumers research and evaluate an insurer’s claim handling reputation before committing to a policy. This scrutiny shows that inefficiencies in disbursement can directly influence customer acquisition and loyalty. The insurance industry is built upon trust, and a reputation for slow and outdated processes can prevent potential customers, impacting market share and growth.

What Digital Disbursement Methods Can Do for Customers

However, embracing a digital disbursement method can yield significant benefits. A report from J.D. Power noted that for homeowners claims processed digitally, the time to payment was reduced by up to 5.5 days compared to traditional methods.

This expedited process not only means you’ve got a more satisfied customer, but think about how much faster you can move through claims. That means not only more business, but the ability to get it done more quickly.

The shift to digital methods streamlines workflows, reduces error rates, and optimizes the resources available.

Embedded Finance for Insurers from Juice

Juice’s embedded finance solutions are designed to integrate smoothly with existing insurance systems. This seamless integration means that insurers can upgrade their disbursement methods without the need for extensive overhauls. The ability to provide instant disbursements, where customers are able to receive funds directly to their digital accounts, is a convenient leap forward in customer service.

- Reduced Processing Time: Embedded finance can significantly decrease the time taken for claim payouts, perhaps through Juice Cards, improving customer satisfaction.

- Cost Efficiency: The automation and digitization of the disbursement process can lead to considerable savings.

- Improved Data Accuracy: Digital transactions reduce the likelihood of errors inherent in manual processes, ensuring higher accuracy in disbursements.

- Increased Customer Engagement: Offering modern, efficient financial solutions helps build stronger relationships with policyholders.

In fact, one leading insurer working with Juice saved an estimated $250,000 per year by eliminating paper checks, while increasing loyalty with its customer base due to expedited claim payouts.

Juice has been processing payments like these for over 20 years, with over $20 billion in gross volume processed. When you need a trusted partner to improve your claims payouts, you can count on Juice.

Transforming Disbursements with Embedded Finance

Why is implementing embedded finance worth it for insurance companies? Not only does it improve inefficiencies, but one of the overall benefits of embedded finance at large is driving customer loyalty. A study from IBS indicates that 22% of respondents claim they are more likely to shop with brands offering embedded finance solutions.

By integrating financial services directly into insurance platforms, you offer your customers a more streamlined, efficient, and user-friendly experience. The integration is key to reducing the administrative overhead associated with traditional methods – significantly cutting down on processing time and costs.

The bottom line is that embedded finance solutions, such as those provided by Juice, mark a significant advancement in the insurance sector by addressing the historical challenges of disbursement inefficiencies. This advanced technology not only streamlines the payment process but also enhances customer satisfaction.

Interested in learning what embedded finance solutions Juice can offer? Contact us today!