90% of Americans say that finances impact their stress levels – and it’s a problem that is affecting more than their mental health. A huge part of the workforce doesn’t just want their earned wages on demand – they need it.

How does this stress and need for instant pay affect employers? When employees are financially stressed, they are less engaged and are more inclined to leave their positions. To overcome this challenge, employees need to consider offering more flexible wage access options.

One trend that is changing the modern workplace is earned wage access (EWA). A new era of FinTech solutions is enabling faster pay, disrupting the classic two-week, paper check payroll cycle. Employers, such as payroll companies, staffing agencies, and those who are eager to mitigate rising employee turnover rates, are embracing earned wage access as a payroll perk.

But how does earned wage access overlay your payroll process? How can it boost retention rates and ease the stress of your employees? To answer these questions, we’ve created this guide on EWA.

Feel free to click the following chapter headers to automatically scroll to your needed answer:

- What is Earned Wage Access?

- How Does Earned Wage Access Work?

- What Companies Benefit from Earned Wage Access?

- Are Paper Checks Really Outdated?

- What is On-Demand Pay & How Does it Improve Employee Satisfaction?

- Is Instant Wage Access Right for My Organization?

- What Questions Can I Ask When Choosing an Earned Wage Company?

- Why is Access to Early Pay the Future of Payroll?

- Why Do Employees Want Access to Early Pay?

- How Does Instant Pay Access Improve Retention?

- Do Payroll Providers Need to Offer Earned Wage Access?

- Why Does My Organization Need to Offer Earned Wage Access?

- What EWA Solutions Does Juice Offer?

1. What is Earned Wage Access?

Earned wage access is a new trend in modern payroll services that helps employers attract and retain employees.

It’s a new, flexible way to pay employees using modern FinTech solutions.

Early wage access is a rising trend that is changing the way that employees access the wages they earn from an employer. This type of payroll perk has become an effective recruiting tactic, especially for the younger workforce. In fact, the majority (61%) of Gen Z-ers would like their employer to provide the option for an earned daily wage payment.

Early wage access goes by different names, one of the most popular being Earned Wage Access (EWA). You might also hear it referred to as instant pay, instant wage access, wages on demand, or daily pay.

Why has it become such a hot topic in recent years? Employers and agencies who offer early wage access have experienced increased job application rates, less turnover, and a more engaged workforce. And, with the help of the right FinTech platform, EWA is a feasible solution to many different employment struggles.

“A well-designed EWA program can be a successful tool to provide employees with financial awareness and wellness.”

– American Payroll Association, Earned Wage Access Annual Report, 2021

2. How Does Earned Wage Access Work?

With the definition of EWA covered, it’s time to consider how it can actually work for your business.

EWA is an alternative to the traditional payroll cycle that enables workers to access accrued wages on demand. While some companies have offered EWA for a while, historically EWA was very manual and, as a result, very tedious. Relatively small companies even spend an average of four business days processing their payroll.

In recent years, however, new and better solutions to EWA – and payroll in general – have begun to emerge.

Taking an advance of earned wages results in a disbursement of funds allocated by paper check, direct deposit, digital wallet, or reloadable debit pay card. The employee can then access the funds just like normal wages, except with much more flexibility and on demand.

Remember that EWA supplements, not replaces, your existing payroll process.

3. What Companies Benefit from Earned Wage Access?

As much as 76% of the workforce, across all age groups, want EWA and believe it’s important for employers to offer. Some will even consider leaving their job for another employer who offers this unique benefit.

What types of companies benefit from EWA? Today, the answer is most employers – but there are certain types of employers in particular that often especially benefit, specifically.

- Employers of Low-Wage Workers

- Employers with a Younger Workforce Demographic

- Payroll Providers

- Staffing Agencies

Earned wage access has become an important consideration for employees in recent years. Between the financial burden of rising costs and tough economic conditions and the general apathetic response from job candidates, modern FinTech solutions like EWA are shining light in a new direction.

Want to stand out as a payroll hero in your organization? Download our free eBook to learn how to maximize your company’s payroll success!

Both employers and employees are favoring the adoption of earned wage access as the new norm.

Next, we’ll talk about how payroll has changed, making paper checks potentially obsolete.

4. Are Paper Checks Really Outdated?

Did you know that nearly half of all employers are still issuing paper checks? Direct deposit has been a modern convenience for decades and yet, some employees are still unable to receive their pay without a paper check.

Since 85% of Americans have a smartphone, newer FinTech solutions like EWA are arriving on the scene to help paper payroll check-bound employers have more options.

The truth is, processing payroll with paper checks is an administrative burden. There are significant costs associated with printing payroll checks that can be eliminated using digital alternatives. Unbanked and underbanked employees are the most likely to receive paper checks, and they are also the most likely to fall victim to predatory fees associated with cashing their checks.

If you replace paper checks with a solution like a reloadable paycard, you can eliminate the time it takes to move money from your account to that of your recipient. When checks are outstanding, it is difficult to reconcile books and ensure proper funds are in your account before you issue the next payment.

Alternatives like EWA offer more security with fewer fees, providing a feasible solution for employees and employers alike.

5. What is On Demand Pay & How Does it Improve Employee Satisfaction?

On demand pay is an alternative payroll service that provides access to wages earned outside of a traditional payroll cycle. Traditionally, employees would work for several weeks before receiving the wages earned during those shifts.

Common payroll cycles offer set payment schedules on a weekly, bi-weekly, or monthly basis. This payroll structure provides little flexibility for workers who encounter financial struggles in between paydays.

With on demand pay, workers can often access wages earned as soon as shortly following their shift. The details of how and when workers can get paid vary by program, so it’s important that employers clearly communicate how the on demand pay program works in order to see the benefits in terms of increased engagement and employee satisfaction.

This type of payroll perk meets a real need, reducing employee financial stress, which in turn improves job satisfaction. Employers who have offered on demand pay report better engagement, less turnover, and more productivity – all translating to higher profits.

Next, we’ll explore whether or not instant wage access is right for your organization.

6. Is Instant Wage Access Right for My Organization?

With inflation remaining stubbornly persistent, the American workforce continues to have serious financial needs. As an employer, it’s important to know what your workforce is facing and how you can help them stay financially well through these challenging times.

That’s why Instant Wage Access is a popular payroll perk for companies in nearly every industry, of every size, and with many different types of jobs. This solution helps ease the burden of financial stress that many employees feel day-to-day.

Knowing that your employees will likely appreciate the flexibility, you might be wondering what else you should consider before giving the green light on a new perk. For starters, instant wage access programs can be administered through reloadable debit cards. This means you could finally eliminate paper checks for all employees and offer more pay flexibility. Some of these cards, like those issued by Juice, can even offer numerous perks and benefits for your employees worth $1,000 or more per year.

Additionally, companies that struggle with high turnover or who are located in areas with a high cost of living can see real benefits from offering instant wage access. This perk helps increase the financial well-being of employees, which in turn improves worker satisfaction, engagement, and motivation.

So, how can you choose the right provider for your employees’ EWA benefits?

7. What Questions Can I Ask When Choosing an Earned Wage Company?

Earned wage access is a fairly new concept in the workplace. While it’s gaining a lot of attention from employers eager to fill positions, the market is still heavily segmented. This means that it can feel like comparing apples to oranges when looking at different earned wage access companies.

Take the time to ask each earned wage access company the right questions so that you can understand how your payroll process will upgrade.

Here’s what you need them to answer:

- How long does it take to get started with an Earned Wage Access solution?

- What is the cost for getting started?

- How do you get the money in the hands of employees?

- What changes will there be in my payroll process?

- What kind of service can I expect from the earned wage access company?

- What type of commitment are you expecting me to make?

- Do I have to spend lots of time talking to a pushy salesperson?

These questions can help you determine how flexible earned wage access companies might be and how well they might fit what you’re looking for.

For example, if the EWA company offers early pay via reloadable pay cards, you might be providing more than early access – you might be saving your workers extra check cashing fees.

Next, we’ll look at early pay as a trend and discuss whether or not it’s here to stay in 2023 and beyond.

8. Why is Access to Early Pay the Future of Payroll?

The concept of same-day pay is still relatively new. Here are three reasons why early pay is here to stay, not just as a convenient perk for employees, but as the future of payroll.

- It’s convenient for employers and employees.

- It helps alleviate financial stress, which boosts productivity.

- It saves money for everyone involved.

FinTech solutions that offer early pay and earned wage access are making it easier than ever before for employers to pay their workers. Early pay programs are here to stay because the technology is available to make the process easy for both employers and employees.

Plus, with all of the economic uncertainty in recent years, more employees are struggling with finances. Employers are becoming increasingly aware of the impact that this stress has on their bottom line and they’re eager to do something about it. Early pay is one way that employers can reduce worker stress.

If those benefits aren’t enough, employers can finally get rid of paper checks and the added expenses of manual payroll. Next, we’ll talk about why this employee perk is something many employees really want.

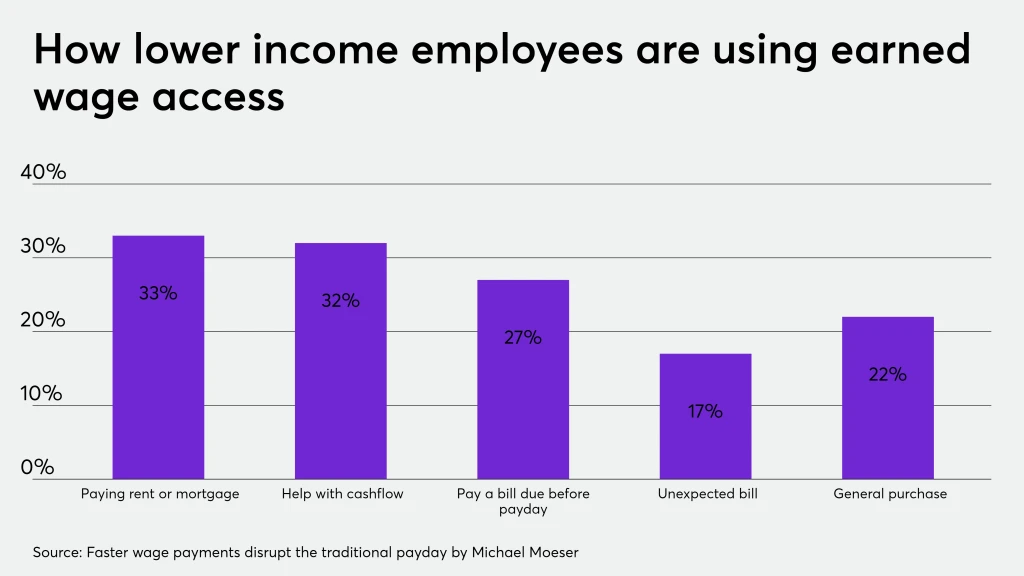

9. Why Do Employees Want Access to Early Pay?

At face value, access to early pay options looks like it favors the instant gratification needs of employees. However, it’s really a mutually beneficial offer. For employees, the early pay perk provides flexibility to access earned wages when they need them to cover the costs of living.

Traditional payroll cycles leave gaps in between paydays where employees live paycheck to paycheck to get stuck relying on high-interest credit cards or, worse – predatory payday loans to cover expenses. This situation creates a lot of personal stress that leaves workers feeling anxious, unhappy, and unproductive.

For employers, this stress manifests in lower productivity, higher turnover, and a dwindling workforce that leaves jobs unfilled. However, early pay benefits have been proven to provide an effective incentive to fill low wage jobs, minimize turnover, and provide a happier, more productive workforce.

“Some industry insiders feel that EWA helps companies offer more transparency with employees. That’s a primary reason why employees appreciate on demand pay.”

Melissa Johnson, VP of Pacific Bells/World Wide Wings

But what is the link between early pay and retention? Continue reading to find out.

10. How Does Instant Pay Access Improve Retention?

With general turnover being high among lower wage workers, there’s plenty of room for improvement.

And the cost to replace a turned over employee can be close to 40% of their annual salary.

Simply put, better retention equals lower costs. Improving retention has become a necessity in the current candidate-driven job market and employers of all types are looking for ways to keep jobs filled.

Instant pay perks are one easy solution that makes a big difference in retention.

For example, in the restaurant industry, a majority (83% of workers) report same-day pay access as a key factor in determining which job to take and when to leave. Flexible pay options help ease the financial stress that generally makes the workforce unhappy.

Alleviating the financial stress is a good first step towards plugging the turnover leak. However, the real power is in the ripple effect. When employers make a move that workers view as helpful, loyalty and engagement increase. Workers have more affinity for their employers and are generally more committed to the jobs they’re in.

How does earned wage access work as an opportunity for payroll providers?

11. Do Payroll Providers Need to Offer Earned Wage Access?

As a payroll provider, your services must directly support your clients’ needs. This means staying on top of hiring and payroll trends and offering solutions that are relevant to the needs of the workforce.

From cost savings for clients to a strong competitive position, payroll providers can use benefits like earned wage access to attract more business.

EWA is mutually beneficial for payroll providers and their clients. And they’re not alone, as 82% of employers are interested in offering this flexible benefit.

As a payroll provider, you can provide wage access as a service, enabling your clients to easily add the perk for their employees.

Doing so can help you stand out from the competition while offering a simple, streamlined experience for your clients. It’s one benefit that offers easy implementation with big rewards.

12. Why Does My Organization Need to Offer Earned Wage Access?

Earned wage access (EWA) is a fast, affordable, and convenient way for organizations to meet the needs of workers in order to boost retention, engagement, and productivity. As many companies struggle to fill open jobs or experience noticeable spikes in turnover, there’s a silver lining in a new wave of FinTech solutions.

Organizations are exploring new ways to manage payroll. Outsourcing can save a lot of money, but the new trend that’s getting lots of attention is earned wage access. A younger and less financially secure workforce paired with the availability of brand new FinTech solutions and accessible smartphone technologies is changing the game for how employees get paid.

Staffing agencies, payroll providers, and direct-hire employers are all exploring earned wage access as a way to reduce employee stress, improve job satisfaction, attract candidates and improve retention. Your organization should consider earned wage access as a cost-effective way to engage the workforce.

13. What EWA Solutions Does Juice Offer?

Juice’s Earned Wage Advance puts financial control in your employees’ hands with instant payments.

Earned Wage Advance from Juice

Zero Cost

No costs. No limits.

Zero cost with no limit on transactions.

Instant

Access within seconds

Access to a portion of their accrued funds prior to payday within seconds.

24/7

access support at all hours

Less stress that leads to better productivity. 24/7 customer support.

When it comes to new solutions for your employees, you want a reliable partner you can trust. At Juice, we’re not newcomers – we’ve been delivering modern FinTech solutions for over 20 years. With more than 15,000 clients on our platform and more than a thousand instantly deployable use cases, leveraging more than 100 banking solutions, Juice is the fastest and easiest way to integrate financial solutions into your business.

30M+

$20B+

100+

15,000+

20+

$60M+

Conclusion: Is Your Company Ready to Implement Instant Wage Access?

In many cases, offering more flexibility using EWA can save money over traditional payroll costs while simultaneously boosting employee retention and productivity. It’s a win-win for employers of all sizes in many industries.

Earned wage access is more than a perk – it’s a key part of the future of payroll. Today, workers are financially burdened and many are stuck in a paycheck-to-paycheck cycle with little or no flexibility. And as a result, many employers are embracing modern Fintech solutions that simplify wages while also adding much-needed flexibility.

Earned wage access is gaining popularity because it’s an easy change that offers big rewards. For employers, it’s a perk that saves money while also making it easier to attract and retain productive workers.

So how can your business get started, without breaking the bank?

Juice Financial makes it easy to handle payroll and pay-based incentives. Learn more about how Juice’s FinTech solutions, including our Earned Wage Advance program, help power your business.