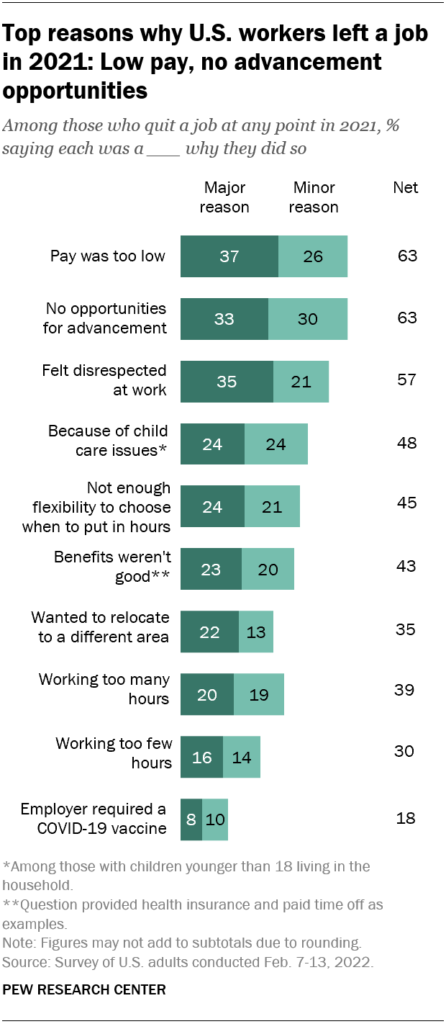

In 2022, pay and benefits topped the list as the primary reason workers chose to leave their jobs, underscoring a major shift in the world of work. Amplifying this trend, over 50.5 million Americans stepped away from their positions by the end of 2022, sparking what became known as a “Great Resignation” that still plagues frontline employers in late 2023.

Via Pew Research

In response to this shift, improving employee retention has catapulted to the forefront of employer priorities. High turnover rates not only tarnish a business’s reputation but also incur substantial financial burdens due to the continuous rotation of inexperienced employees. Consequently, the spotlight is now on cultivating loyalty among employees as a strategy to enhance retention.

One strategy to accomplish this is to implement a total rewards program. This strategy is a blend of benefits, compensation, and recognition. Not only does it include flexible pay, but also extends to scheduling flexibility and career development opportunities.

In this article, we are going to dive into the pillars of total rewards programs and how employers can use this strategy to unlock employee loyalty.

The Pillars of Total Rewards

Implementing a strategy that provides benefits to employees, while going beyond the traditional benefits package, is foundational in developing a total rewards strategy. This strategy has five pillars to consider.

Compensation

Compensation stands as a key driver for employee turnover. Thus, reevaluating and potentially elevating compensation plans is critical for employers committed to improving employee retention.

One approach to improve compensation is to raise an employee’s base wage. However, there are other ways to improve pay. Incorporating variable compensation, which rewards employees who perform well, is another viable strategy.

Additionally, you can improve the way employees access their compensation. Implementing a pay-on-demand solution that allows employees to access their wages as soon as they are earned, instead of waiting for regular paycheck cycles, can help reduce financial stress.

Benefits

Offering comprehensive benefits is another way to foster employee loyalty. Benefits can span a wide range, encompassing financial wellness initiatives, employee recognition programs, opportunities for continuing education and training, along with flexible payment alternatives.

Tailor these benefits to your workforce’s diverse needs, taking into consideration the specific demands of their roles. When deciding which benefits to offer, consider the needs of your workforce. Does their job require demanding physical labor? Consider types of wellness programs that help improve an employee’s physical health.

Work-Life Balance

Creating a culture that supports work-life balance means understanding and valuing what is important to your workforce – be it spending quality time with family and friends, traveling, engaging in hobbies, or simply enjoying rest and relaxation. This involves designing a work structure that accommodates these values without compromising on professional commitments.

Career Development

It’s a simple principle: the more you invest in something, the greater your returns. This truth is perfectly applicable when it comes to employees. When you invest in career development opportunities for employees, you are supporting employee growth, and skill enhancement, and helping retain valuable frontline workers. This kind of employee advancement is mutually beneficial to both employees and employers.

Recognition and Rewards

Organizations with formal employee recognition programs have 31% less voluntary turnover than organizations that don’t have any program at all. This highlights that employees want to be recognized for their hard work.

Acknowledging and appreciating employees for their contributions doesn’t have to be elaborate, but it makes a big difference. Methods such as public praise from their managers or providing a small stipend can boost morale and retention.

How Total Rewards Impact Employee Loyalty

Implementing a total reward strategy can have profound effects on improving loyalty among employees. Recent data from Gallup reveal that a striking 26% of employees often or always experience burnout. Counteracting this can be achieved through a well-structured total rewards strategy that meets the varied needs of employees.

Adopting total rewards not only fosters employee loyalty but can also save your company substantial amounts of money. A recent study found that implementing elements of total rewards strategies, such as recognition, helped a business with 10,000 employees save up to $16.1 million annually on turnover costs. Regardless of your company’s size, utilizing total rewards can have a substantial positive impact on your bottom line.

Total rewards go beyond just flexible pay, culture, or financial well-being–it integrates all these aspects under a single umbrella, offering a comprehensive approach to improving your workforce’s experience.

Leveraging Total Rewards in the Payment Ecosystem

One of the most important pillars of a total rewards system is compensation. Whether it’s offering a higher wage or making adjustments to improve compensation processes, it is a step that cannot be overlooked.

Given that many employees live paycheck to paycheck, facilitating timely payments is imperative to help them meet their financial obligations. Implementing solutions like earned wage access (EWA) is an alternative payroll option that grants employees access to their accrued wages more frequently.

Wages can be issued to employees through traditional payroll means like direct deposit or paper checks, or through more modern means, like a reloadable paycard or a digital wallet and mobile app, to help foster a sense of financial stability.

Check out our employer’s guide on “How Does Earned Wage Access Work?”

Consider leveraging the latest innovations in FinTech to enhance a total rewards strategy. Given the substantial time people spend on their smartphones, businesses are eager to elevate the employee experience through the incorporation of embedded finance.

Embedded finance involves integrating financial services, such as payments, directly into non-financial companies’ processes. One practical approach is utilizing reloadable pay cards that could include stipends tailored toward the specific needs of the company and/or employees.

This is an easy, digital way of delivering these benefits to your workers at zero cost!

Ready to Boost Retention Rates & Employee Loyalty?

Adopting a well-rounded total rewards strategy tailored to meet your employees’ needs can foster a deeper commitment toward your organization.

But how can employers manage this for thousands of employees?

Explore Juice’s modern FinTech solutions into your total rewards strategy! Utilizing these resources not only streamlines payment processes but also introduces greater flexibility in wage access, potentially reducing company expenses in the long run.

Discover more about what you can do for your workforce with Juice Financial today!