Banking

as a

Service

Banking as a Service (BaaS) is quickly becoming one of the most dynamic parts of the financial industry.

It’s not surprising that the global BaaS market is projected to grow over five times over the next decade according to Allied Market Research. Emerging applications such as embedded finance for insurance companies show that we’re only scratching the service of BaaS potential. We’re about to witness a significant shift – where financial accessibility and efficiency will be propelled to new heights.

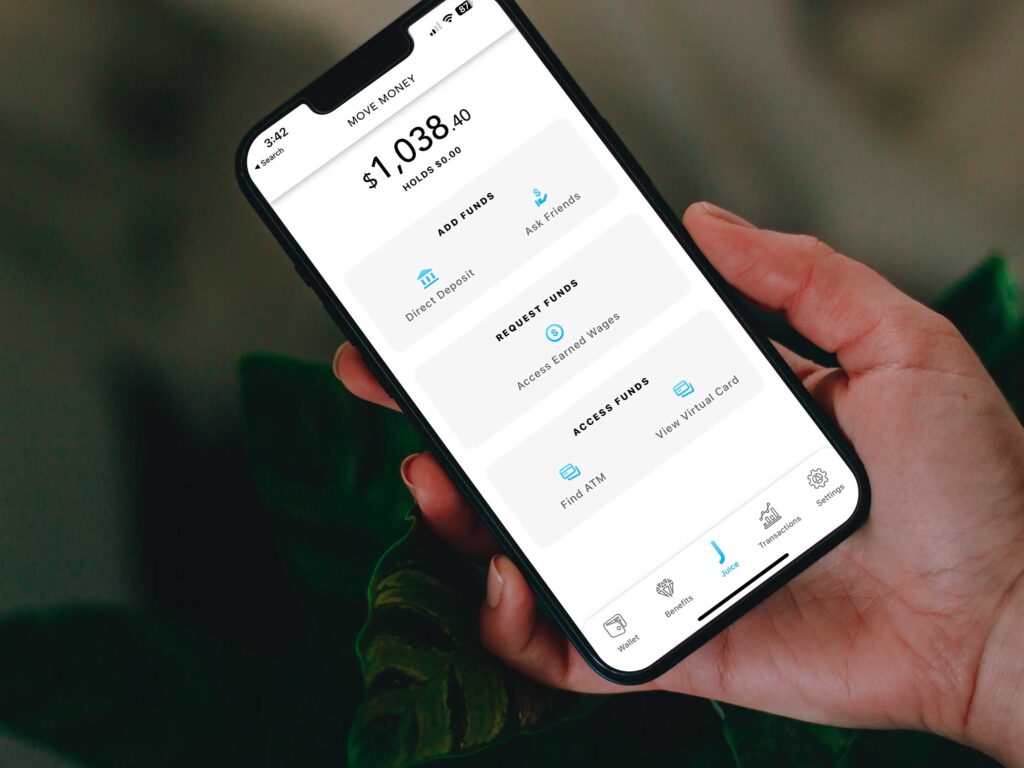

Juice Financial, a leading FinTech company that’s served over 30 million customers, has a long history of disrupting the FinTech space. Now, with a reputation built on redefining user experiences and offering rapid, reliable, and flexible financial tools, Juice is further disrupting the BaaS sector.

What is Banking as a Service?

Examples & More

Banking as a Service is a model where financial services are seamlessly integrated into the offerings of non-financial companies through APIs. Unlike traditional banking partnerships that typically offer co-branded, store-specific credit cards, BaaS provides a more flexible and deeply integrated financial solution.

Primarily utilized by non-banking entities, BaaS creates a more interconnected, customer-centric financial model. It’s built on the concepts of flexibility and technological prowess that are redefining how financial services are accessed in various industries.

When harnessed correctly, BaaS allows businesses to embed banking operations within their ecosystems. This evolution towards a more customer-centric financial landscape empowers people to take more control of their finances. For instance, Juice has designed a BaaS solution for pay cards, which reduces dependency on check-cashing services and provides greater financial control and flexibility.

How Juice Jumps at the Challenges and Opportunities of BaaS

Despite the promise of BaaS, adopting it can raise issues around regulatory compliance and technology integration. And that’s where companies need a trusted partner.

Juice addresses these by leveraging over two decades of experience providing out-of-the-box and custom BaaS solutions. We’ve worked with tens of thousands of clients to ensure the right-fit solution for their needs – all while setting an industry standard for customer service. In a disruptive space, a clear process and a hands-on team instill confidence into businesses that might need a bit of assurance when utilizing new technology.

Juice’s BaaS solutions help businesses cut down on blocks, scale operations, and innovate offerings. From insurance to expense management, and from employee payments to government disbursements, Juice helps companies implement modern, easy-to-use solutions.

This approach meets the needs of modern businesses seeking financial integration. And while one massive benefit is reduced revenue, there are numerous other benefits from Juice’s embedded finance solutions as well. It can enhance customer experience, increase accessibility for underserved and underbanked individuals, and provide a more personalized, data-driven financial option.

4 Real-World Banking as a Service Examples from Juice

All of this sounds good on the surface level, but what does BaaS look like in practice?

Here, we outline how Juice’s technology has been utilized by different industries. These examples offer a picture of how something that may seem relatively small can truly be transformative for a business.

1. Reduced Claims Settlement and Cost for Insurance Disbursements

The world of insurance is built upon a massive amount of data and information. That’s an obstacle for providers in the modern world.

At AFR Insurance, they faced several challenges in this area – including lengthy claim payouts where policyholders waited for up to 20 days, high administrative costs exceeding $50,000 annually for processing checks, and a significant rate of data inaccuracies in ACH data. The end result was a challenging and very not innovative customer experience.

It was a situation that was bad for external relationships, bad for internal teams, and bad for business at large.

Juice’s BaaS technology provided a solution through instant payments. AFR was able to begin providing instant claims payments. The shift not only improved efficiency, but led to substantial cost savings – with an estimated $250,000 saved annually.

The result was an innovative process that not only improved customer experience but turned into a competitive differentiator: the ability to get paid for insurance claims virtually instantly.

2. Streamlined Expense and Stipend Management

Viceroy/Legacy is a leader for trustee and beneficiary account disbursements. A key component of their offering is being able to enable pre & post controls on beneficiary spending. They also need to be able to carefully manage expense fraud, while still providing as seamless and fast of a payout as possible.

Juice custom-tailored its Expense solution, showcasing our ability to take out-of-the-box solutions and rapidly customize them to carefully meet customer needs. Remarkably, Juice managed to get this customized program up and running in only 9 weeks.

By implementing granular spend controls, trustee companies can now restrict spending to specific categories. Receipts can be auto-captured through Juice’s innovative mobile app, ensuring the needed records are kept while reimbursements are processed faster than ever. And leveraging Juice’s decades of expertise, the entire system reduced the risk of fraud while still delivering a vastly improved customer experience.

3. Improved the Flow of Government Disbursements

What about getting payments to the underserved? This remains one of the biggest obstacles of a growing cashless world. JPay is a service with the goal to provide electronic payment, email, and communication services to correctional facilities. They faced the complicated challenge of disbursing funds to these individuals due to limited banking access and varied legal requirements across jurisdictions.

This was quite the challenge, as these users cannot handle cash in a facility, but still need to purchase goods and services. Furthermore, high check cashing fees were a burden for recipients whose cash supplies were already constrained.

In response, JPay collaborated with Juice to create the first-ever reloadable card for correctional facilities. The innovative solution meant users wouldn’t have to deal with the obstacles of traditional banking. Plus, they managed to save over $1.5 million annually in check cashing fees. The partnership markedly improved the user experience. It streamlined fund management and access – and set a new standard in government disbursement processes.

4. Enhanced Employee Satisfaction Through Paycards and Same Day Pay

More and more, traditional payroll cycles paid through paper checks payments are inefficient and inconvenient for employers and employees alike. Towne Staffing, a nursing agency, dealt with the inefficiencies of this process – a combo of high check cashing fees and administrative burdens from daily check printing. Plus, the employees desired to be paid faster.

Juice’s solution was the introduction of reloadable debit cards, providing immediate access to earned wages. This system facilitated payment distribution across a broad area. It reduced administrative tasks significantly – saving over 80 hours monthly. What’s more, its employees benefited from serious savings on check cashing fees totaling $277,000.

These results led to improved employee satisfaction and showcased the efficiency and employee-focused benefits of Juice’s BaaS solutions, including Earned Wage Advance.

Step into the Future with These Banking as a Service Examples and More

These case studies illustrate but a few of the virtually endless banking as a service examples businesses can employ.

Partnering with a company like Juice, with technology proven by many billions of dollars processed, is the key to effectively implementing BaaS at your company. Having a partner who works closely with you to understand your needs is imperative. With our expertise and robust underlying technology, you can trust that we can have your solution operational faster than you might even imagine.

Plus, with tools like Juice Mobile and Juice Admin, every part of your value chain – from end users to administrators – can be empowered through best-in-class modern technology.

Let’s talk about how these Banking as a Service examples from Juice will transform your business – and prepare it for the future.